Why & How is Connected TV the biggest wave Automotive Advertisers have witnessed

At a time when worldwide auto sales are declining, the industry is slashing costs and Automotive advertising & marketing dollars are a primary target for these cuts. Looking for less expensive advertising opportunities, automotive advertisers are turning to Connected TV (CTV). Not only is CTV advertising economic but also more effective, flexible, and accountable. Above all else, it’s exploding and will continue to do so in the years ahead. Advertising campaigns using these digital services are much more efficient and effective. Advertisers, gain the ability to target their audience and economize their efforts.

Not only is CTV advertising economic but also more effective, flexible, and accountable. Share on XU.S. auto advertising, across 14 key markets, totaled approximately $18 billion in 2018. Down 12% since 2012. With 54% or $9.7 billion earmarked by top automakers for the television ad market. Dropping 2.3% in 2020. In contrast, automotive companies will allocate only 22.9% of their advertising budgets towards digital advertising in 2020. A rise roughly equal to the percentage fall in total ad spending

Toyota has been the biggest of big spenders in auto TV advertising this year. During Super Bowl LIV this past February, the company spent $20 million alone. In line with the other top tier advertisers, including the likes of Google and T-Mobile. Lincoln Mercury’s (LM’s) Matthew McConaughey ad, a partnership beginning in 2014, has gone viral over the years. Spoofs by Jim Carey on Saturday Night Live and Ellen Degeneres extended its reach across many channels. Responsible for a 13% rise in LM sales as soon as two months after its initial 2014 airing. And continues to drive sales for LM and popularity for McConaughey.

There are four key ‘Pain Points’ facing auto advertisers moving forward.

Underlying their decisions is the fact that scale can also become a liability. Giants move slower.

The limitations of television advertisements weren’t apparent until the next generation of entertainment took the form or OTT & CTV. Being one of the largest spenders in television ads, automotive faces the most urgency to adopt these advanced advertising technologies. As they continue to bear some serious pains from linear tv ads, besides throwing out millions of dollars on them.

Limitations of Traditional Television Advertising

Viewer Targeting Limited to Content Only

Traditional TV advertising uses imprecise methods of targeting. Focusing on content-based ‘day-parts.’ Prime-time, for instance, to determine the number of viewers across varying demographics. Or interest-specific content like sporting events and awards shows. On the bright side for linear TV advertisers, this means there are a lot of eyes learning about their products. But, at the same time, not all viewers are potential customers and thus not in the market for their wares.

Higher Cost

Advertisers must pay higher rates for TV programs with large audiences but limited targeting capabilities. In peak time slots to ensure exposure to their desired demographics. For example, targeting young adults in the age between 21 to 35 in the Bay Area, the local TV spot market buy might cost up to $315 per thousand (CPM). Given the digital nature of CTV’s., the same demo. in the same market, regardless of programming might cost around $40 to $50 CPM.

A Shrinking Viewing Audience

There are currently about 90 million traditional cable and satellite pay-tv service subscribers. Losing a combined 14,000 customers per day. This industry segment will see more than 20 million leave over the next four years. A loss of 39 million customers in 2019 and a whopping 50 million less in 2022.

Lack of Flexibility and Responsiveness

To determine the effectiveness and success of their buys, it could be a week before TV ratings are known. It’s also important to note that viewer demographic results are statistical approximations. Not based on actual individual viewer data. The ability to adjust buys, strategies, and focus is a slow and broad brush. A bit oversimplified, but TV advertising is akin to tossing a can of paint on the wall and seeing what area is covered. Except the results are slower and as limited as the ability to target viewers.

There’s an adage that “change comes slowly.” And that is true for automakers in making the transition from traditional TV to CTV and OTT advertising. But change is a relative term. Spending on CTV advertising will increase by $2.16 billion next year, not exactly chump change.

Despite the higher costs and limitations of traditional TV advertising, automakers still love this medium. According to the Video Advertising Bureau (VAB), in a study of 25 car companies, a 15% rise in TV ad spending produced a 48% jump in unique website visitors. While equal spending cuts resulted in a fall of almost 30%. Stats like these make it difficult to leave a decades-long relationship that has served automakers so well. Without similar studies for digital advertising, it’s hard to show a clear cut apples to apple relationship for comparison. A direct dollar for dollar, viewer vs. user comparison leaves advertisers with a leap of faith decision to migrate to CTV.

But there is clear evidence that CTV offers direct solutions to the pain points inherent in the linear advertising.

Advantages of CTV over linear TV

Targeting is Smarter.

No more guesswork with targeting, pick exactly who you want to show your ads to. Targeting is a distinct advantage of Connected TV Advertising. Buys are based on the audience, not just content. This provides greater specificity in reach and targeting. Product advertising focused on well-defined demographics and audiences. Across a broad swath of digital mediums. Not just, ‘What’s on TV.’ Audiences using Smart TVs, devices like Roku, game consoles such as Xbox and PlayStation. Targeting to the desired demographic within these audiences, regardless of content or application.

In Connected TV Advertising buys are based on the audience, not just content. This provides greater specificity in reach and targeting. Share on XPay only for what works, don’t waste ad budgets on loose bets.

As an example earlier in this post demonstrates. CTV Ads, targeting the same market and demographic, may in some cases cost 80% less. This allows advertisers to appeal to more viewers/users for the same cost or the same number for much less.

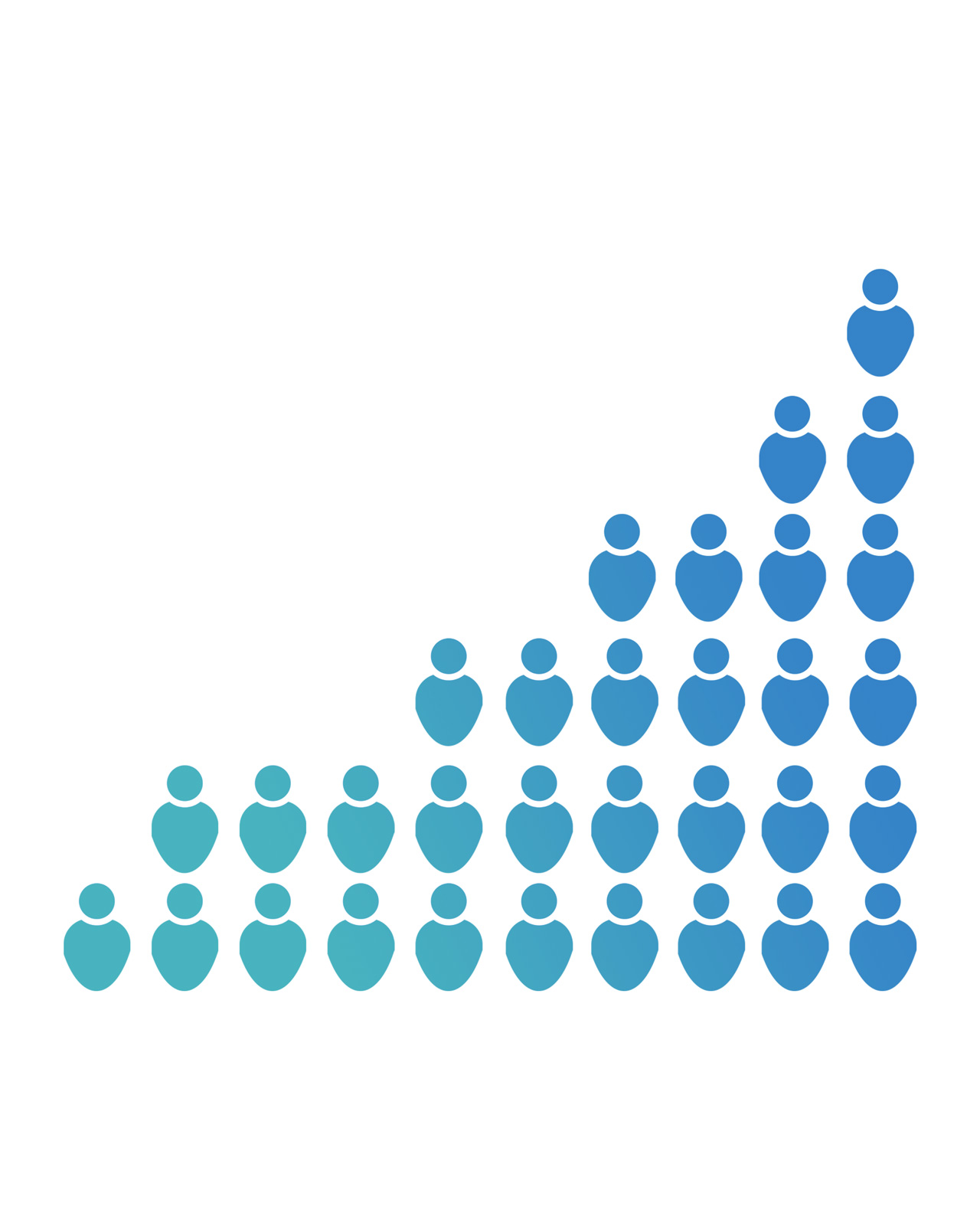

Growing Audience.

People aren’t watching lesser TV, they just moved to a different platform. With linear TV losing viewers by the tens of millions over the next four years. These so-called ‘Cord Cutters’ will be among the 200 million CTV users in the U.S. These numbers speak for themselves.

People aren’t watching lesser TV, they just moved to a different platform. Share on XUnlike traditional TV advertising, measures are in real-time.

CTV Advertising Technology is clearly superior to linear TV when it comes to real-time analytics. Make decisions based on meaningful metrics that directly tie to the success of your campaigns. More specific and timelier results allow advertisers to use their budgets more wisely by optimizing which ads and targets should be continued and/or changed. Precisely what auto advertisers need.

CTV provides specific and timelier results allowing advertisers to use their budgets more wisely by optimizing which ads and targets should be continued and/or changed. Share on XAutomotive has been one of the biggest spenders on TV, and when innovation strikes, it hit them the hardest with Digital Marketing. With more and more budget being moved to Digital, CTV provides a second chance to grab the attention of the television watching audience. Providing an antidote for an ailing market when advertising dollars are more precious and the need to drive sales more urgent. This is why Auto + CTV is a perfect coalescence.

At Demand Local, we aim to educate and provide strategies to Executives and Sales Professionals in Auto Advertising & Marketing for them to grow and scale their businesses.

Talk to the experts at Demand Local to learn how you can take advantage of our powerful CTV marketing tools.